Get Faster Payments with TimeSolvPay

TimeSolvPay offers next-day funding, combined with online payment links in your email invoice, so you get paid faster.

The TimeSolvPay Difference

Securely accept credit card, debit card, ACH payments, and electronic checks through TimeSolvPay, either online or in-person, using technology that powers billions in transactions.

Achieve Zero AR

Client Convenience

TimeSolvPay provides an online payment solution with a custom-built portal that allows law firms to easily track data and get instant visibility into deposits.

Compare and Save

TimeSolvPay provides the best rates in the legal collections industry, saving you on processing and transaction fees.

We have purchased or demoed countless billing solutions in my firm's multi-year quest to find a better alternative to Timeslips. Clio, Amicus, Bill4Time, Cosmolex, Firm Central, Cosmolex, QuickBooks, eBillity, MyCase, you name it, we tried it. Then we stumbled across TimeSolv. It is outstanding in every way and the simplicity of the user interface has led to ready adoption by everyone in the office and higher usage, and time capturing ratio, than we have ever experienced.

Easy to use, billing process is super fast. I moved from a slow and buggy desktop legal practice program, while functional was utterly infuriating to TimeSolv, which has been a revelation. By far, the best time and billing product I have used or reviewed.

We rarely encounter any difficulties with using TimeSolv (and when we do, it's usually something we have overlooked.) But when we need help, that help is there immediately. They are meticulous, thorough, and courteous. It is a pleasure to work with them.

TimeSolv is powerful enough to meet my needs, but simple enough to be easy to use and understand.

TimeSolv is reasonably priced and not encumbered by a lot of features I don't need or want.

When I finally made the move, in less than a week, I was set up and fully ready to use TimeSolv with 17 years of Timeslips data converted into the program.

Customer service is excellent and the program is easy to use. I wish I had made the switch years ago. Complacency with an inferior product often delays progress.

TimeSolv has made keeping track of billable time and the invoices extremely easy. Everything you could need is included with TimeSolv. It is easy to navigate and user friendly.

TimeSolv is hands down the best legal billing program available today. With more than 20 years in the legal industry, I've worked with a variety of legal billing programs, and this one tops the cake.

TimeSolv Features for Modern Law Firms

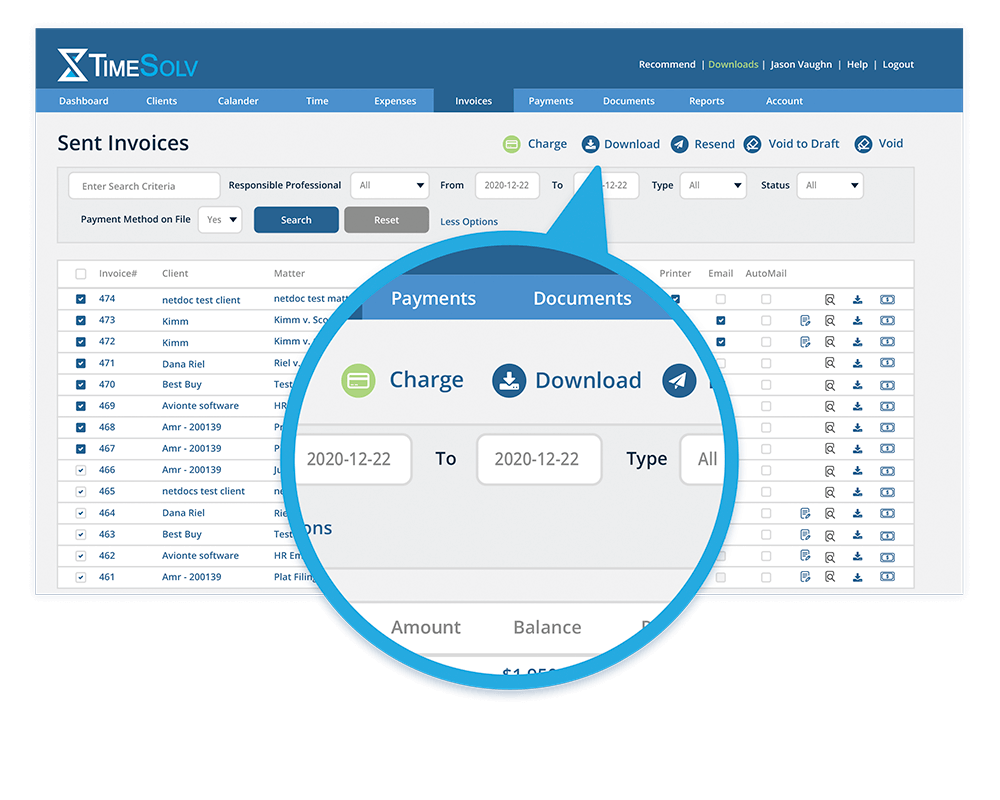

Run Payments in Batch

Capture More Time

Flexibility

FAQs about Payment Accepting Solutions for Law Firms

First Hidden For all Closed

What payment options are available to law firms?

How do law firms benefit from accepting electronic payments?

Electronic payments and online payment methods can also help law practices improve client relations. Legal clients do not like spending extra time delivering their payments to a physical office or mailbox. It is much easier and more convenient to pay a legal billing invoice from the comfort of home, or even on the go. Some law firm clients feel more secure using credit and debit payment options, while others appreciate the ability to pay off their legal fees over time. Whatever the client’s reasoning, law firms that offer a variety of payment methods are better positioned to receive the benefits even if transaction or credit card processing fees apply. Presenting better options and delivering high-level service results in improved client satisfaction.

How can law firms navigate the rules and regulations of accepting in-person and online credit card payments?

Before integrating online payment platforms, law firms should conduct thorough research on the rules and regulations set forth by their state bar associations and consider any ethical considerations. Barring any infringement on ethical rules, law firms need legal payment processing software that is specifically designed to meet the industry needs. These companies processing payments typically have systems in place to automatically handle these process requirements and provide credit card processors and ACH solutions for attorneys by promoting compliance with ABA and IOLTA guidelines, specifically in the instance of advance payments and trust accounts.

Which payment methods promote faster law firm compensation?

One of the quickest ways for law firms to secure compensation is stored payments, coupled with running batches of automated payments. With stored online payment methods, clients provide the details of their preferred payment method, whether it is a credit card or bank account, to the firm, along with a preauthorization for payment. On the agreed upon date of the month, the law firm continues electronic payment processing from the stored form of payment. With batch processing, firms can use stored methods to secure regular payment from numerous clients simultaneously, providing a legal payment solution that gets firms paid in minutes.

How can law firms ensure the security of client payment information?

Keep Your Business Running Smoothly

Try TimeSolv for Free. No Commitment, No Hassle, No Credit Cards.